Update QuickBooks Desktop: A Simple Guide to Staying Current & Secure

- jameswaton014268

- Jan 20

- 6 min read

Do you keep clicking "Remind Me Later" when QuickBooks asks to update? You're not alone, but hitting that button can lead to bigger problems down the road. Keeping your software updated is one of the most important—and easiest—things you can do to protect your financial data and keep your business running smoothly. This guide will explain exactly why updates matter, break down the different types, and give you a foolproof, step-by-step process to update QuickBooks Desktop safely and successfully.

Why Updating QuickBooks Desktop is Non-Negotiable

Think of your QuickBooks software like your car. You don't just drive it until it breaks down; you get regular oil changes and tire rotations to prevent problems. Updating QuickBooks is that essential preventative maintenance for your accounting system.

When you update QuickBooks Desktop to the latest release, you're not just getting new features. You're installing critical fixes that:

Protect Your Data: Updates patch security vulnerabilities that could expose your sensitive financial information.

Ensure Accuracy: They deliver the latest tax tables and forms, so your payroll calculations and filings are always correct.

Fix Known Bugs: Intuit resolves issues reported by other users, preventing crashes, errors, and glitches you might not have even encountered yet.

Maintain Compatibility: Updates ensure QuickBooks works seamlessly with your operating system (like Windows 11), your bank (for downloads), and other integrated apps.

Skipping updates is a risk you can't afford. It can lead to corrupted data, failed payroll runs, and costly compliance errors.

The Different Types of QuickBooks Desktop Updates

Not all updates are the same. Understanding what you're installing helps you know what to expect.

Maintenance Releases (R-Series Updates): These are the most common. Think of them as "tune-ups." They fix a collection of bugs and performance issues. You'll see them labeled with a year and release number (e.g., R12 for 2024). Installing QuickBooks Desktop maintenance releases is crucial for stability.

Payroll Updates: These are critical and time-sensitive. They contain the latest federal, state, and local tax rates, forms, and compliance rules. If you run payroll in QuickBooks, you must install these updates before processing any paychecks to avoid costly errors. This is the most important reason to update QuickBooks payroll regularly.

Major Feature Releases: These come with new tools and significant improvements to the software. They often coincide with a new year's version (like upgrading from QuickBooks 2024 to 2025) but can also be introduced in larger maintenance releases.

Security Updates: These are deployed to address specific security vulnerabilities. They are often included in maintenance releases but may be pushed out separately if a critical threat is identified.

The Top Benefits of Updating to the Latest Release

Making the update QuickBooks Desktop process a habit delivers clear advantages:

Peace of Mind with Security: Your business financial data is a prime target. Updates are your first line of defense against emerging threats.

Fewer Headaches and Errors: By fixing known bugs, updates prevent the frustrating errors and sudden crashes that interrupt your workflow.

Access to New Features and Improvements: Get tools that save you time, like better reporting, streamlined workflows, or enhanced invoicing features.

Guaranteed Support: Intuit's support policy often requires you to be on a recent version. If you have an issue and are several updates behind, you may be told to update first before receiving help.

Smoother Integrations: Third-party apps (like payment processors or time-tracking tools) are tested with the latest releases. Staying updated ensures these connections work flawlessly.

Step-by-Step Guide to Update QuickBooks Desktop

Follow this process to ensure your update goes smoothly every time.

Before You Start: The Golden Rules

Backup Your Company File: Always, always create a verified backup (File > Back Up Company > Create Local Backup). This is your safety net.

Close QuickBooks: Ensure QuickBooks is completely closed on all computers (in a multi-user setup, every single user must log out).

Pause Antivirus Software: Temporarily disable your antivirus/firewall software, as it can sometimes interfere with the installation. Remember to turn it back on afterward.

Method 1: Updating Automatically (Recommended)

This is the easiest way for most users.

Open QuickBooks Desktop.

Go to the Help menu in the top bar and select Update QuickBooks.

Click on the Update Now tab.

Click Get Updates. QuickBooks will connect to Intuit's servers and find all available updates for your version.

You’ll see a list. Ensure all relevant updates (especially payroll) are checked.

Click Download & Install Updates.

Follow the on-screen prompts. The software will close and the installer will run.

Once complete, restart QuickBooks. You can verify the update under Help > About QuickBooks.

Method 2: Manual Download & Installation

Use this if the automatic method fails or you have a very slow internet connection.

Visit the official Intuit QuickBooks Downloads & Updates page in your web browser.

Select your exact QuickBooks product (e.g., Pro, Premier, Enterprise) and year.

Find the latest release and download the standalone update file (it will be a .exe file).

Close QuickBooks completely.

Navigate to your downloads folder and right-click the downloaded .exe file.

Select Run as administrator.

Follow the installation wizard to completion.

After the Update:

Open your company file. QuickBooks may need to update it to the new release, which is a normal process.

Verify your data. It's a good practice to go to File > Utilities > Verify Data to ensure everything is in order after a major update.

Check payroll tax tables. Go to Employees > Get Payroll Updates to confirm you have the current tax tables.

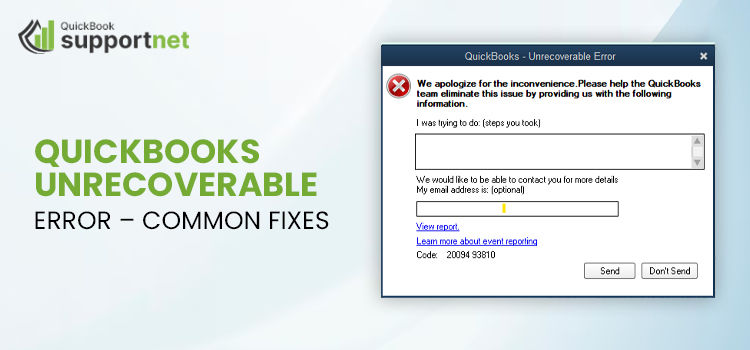

How to Troubleshoot Common QuickBooks Update Errors

Sometimes, the update process hits a snag. Here’s how to fix frequent issues:

Error 12007, 12002, or 1603: These are often network or permission errors.

Fix: Run QuickBooks as an Administrator (right-click the icon, select "Run as administrator"). Temporarily disable firewall/antivirus. Use the QuickBooks Install Diagnostic Tool (available free from Intuit) to repair damaged Microsoft components.

Update Fails or Gets Stuck:

Fix: Restart your computer. Use the QuickBooks Tool Hub (download from Intuit). Inside the Tool Hub, use the Program Problems section and run the QuickBooks Install Diagnostic Tool and then the File Doctor.

"Could not create a backup" Error:

Fix: Manually create a backup before updating (as instructed above). Also, ensure you have enough disk space on your hard drive.

Payroll Update Not Appearing:

Fix: Ensure your QuickBooks subscription is active. Go to Employees > Get Payroll Updates and click "Reset Update." If issues persist, manually download the payroll update from the Intuit website.

Best Practices for a Smooth Update Process

Schedule Updates: Pick a low-activity time, like after hours or on a weekend, to avoid disrupting your work.

Update All at Once: In a multi-user setup, the update must be installed on the server first, then on every workstation. Have all users log out during the server update.

Keep Windows Updated: Many QuickBooks update errors are caused by an outdated Windows OS. Run Windows Update regularly.

Use the QuickBooks Tool Hub: This free toolkit from Intuit is your best friend for fixing stubborn installation and update problems.

Don’t Ignore Notifications: When QuickBooks alerts you to a payroll update, treat it as urgent.

FAQs About Updating QuickBooks Desktop

Q1: How often should I update QuickBooks?

A: For payroll updates, install them immediately when notified (usually before each payroll run). For maintenance releases, check monthly or as soon as you see a notification. Don't let more than 2-3 releases pile up.

Q2: Will updating QuickBooks delete my data?

A: No, if done correctly. Your company file data remains intact. This is why creating a pre-update backup is the critical first step—it protects you in the extremely rare case something goes wrong.

Q3: Can I skip an update and jump to the latest one?

A: Yes. When you run the update process, it will always fetch and install the very latest QuickBooks release available for your version. You don't need to install every single past update.

Q4: What’s the difference between updating and upgrading?

A: Updating means installing the latest patches and fixes for your current version (e.g., 2024 R5 to 2024 R6). Upgrading means purchasing and moving to a new year's version (e.g., from QuickBooks Desktop 2024 to 2025).

Q5: Do I need to be in single-user mode to update?A: Yes. For the actual installation, QuickBooks must be closed on all machines. In a multi-user setup, update the server first while all workstations are closed, then update each workstation.

Q6: The update keeps failing. What’s my last resort?A: Use the QuickBooks Clean Install Tool. This will completely remove and then reinstall a fresh copy of QuickBooks. You then restore your data from the backup you (hopefully) created. This fixes even the most stubborn corruption.

Comments